End the Fed End the Fed

by Ron Paul

No mo' money outa 'thick' air

Stand back! We don't know how big this thing is gonna get! — Adam

Today, I review The Book of the New Century... which, of course, needs to be qualified with innumerable adjectives.

Such as political, economic, financially liberating, revolutionary, and "ding-dong da witch be goin' down, baby!" The witch being: Today, I review The Book of the New Century... which, of course, needs to be qualified with innumerable adjectives.

Such as political, economic, financially liberating, revolutionary, and "ding-dong da witch be goin' down, baby!" The witch being:

- the power elite

- the Cartel

- the Oligarchy

- the Controllers

- the Kleptocons (my concept)

- the alien space lizards (also my concept)

- the Ancien Regime

- the Goldman Sachxons

- or fill in your term ...

... whatever name you wish to use for the concept of the <centralized dominating authority (CDA)> in modern Western civilization.

The Golden Rule[1] has never been repealed. Over the centuries, relatively few men and organizations of men have connived—with alarming success—to funnel $trillions in wealth from normal productive humans[2] surreptitiously into an obscure, even occult, matrix of unimaginable power and money.

But I'm not here to revisit a description of the Puppetmasters, only to state without fear of contradiction that the <CDA> a) exists, and b) requires a government-monopoly central bank to accomplish Grand Theft Human. Central banking is the Leviathan-sized cookie jar from which those who live on the backs of others snatch all the goodies. As Dr. Paul points out in his marvelous book, Karl Marx's fifth plank of the Communist Manifesto mandates a strong central-bank monopoly:

"Lenin is said to have declared that the best way to destroy the the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens..." — from Keynes, J.M, Tract on Monetary Reform (1923)

Socialism and Corporatism: An Aside

Wait a minute: How does a central bank manage to serve the ends of state socialism while at the same time channel vast amounts of loot to a coterie of capitalists?

First, these are not your father's capitalists... they are not free-market, voluntary-choice, beat-a-path-to-the-best-mousetrap captains of industry—who neither seek nor promote government favors. No sir. These are the so-called "finance capitalists," Kleptocons, who have tricked the people into giving them—qua insider experts—the keys to the sole money-vault in town... as they cleverly, quietly, and systematically divert more and more of that money to themselves—typically for grandiose projects, like wars for <holy causes> or affordable housing for crack addicts.

While posturing as protectors of free enterprise and sound banking!!!

Second, in the grand scheme of the cosmos, state socialism is the channeling of vast amounts of loot to a coterie of "finance capitalists." The socialist coterie simply has a more matriarchal style. When all is said and done, the little woman behind the curtain—the iron fist inside the velvet glove of egalitarian platitudes—is the money-grubbing criminal operation of the modern state itself, a 'mother knows best' corporatism.

This brief aside is intended to dispel at the outset any illusion that any difference exists between left-wing central-bank looting and right-wing central-bank looting... at least from the perspective of the lootees.

The Big Picture

As we examine the US central bank, the Fed, we need to keep in mind that all of the Western, and non-Western[3], central banks function more or less in subordination to "the Central Bank"... structured as a diffuse hierarchy with control channels in every subordinate institution, but headquartered in the City of London. Who is "it?" Who is "the Central Bank?" Later. For now, let's simply call it "the R"... and recognize that it owns/controls $100 trillion to $500 trillion[4] of current economic value. That's a fact, Jack.

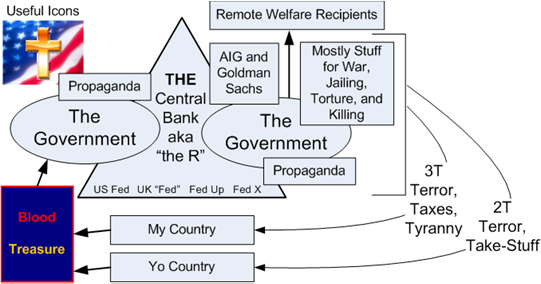

Figure 1: Flow Chart for the Current Monetary System—Uppa US

Because of the control structure, it's fair to state that when the central bank of the United States, the Fed, issues a loan to our government—so it may "buy" (hand your money to its friends for) much-needed B2 bombers or armies of Blackwater mercenaries—the financial institution that actually receives the bulk of the repayment and interest (your money) is "the Central Bank," which is to say "the R." [And a highly funded-and-motivated group of "R" up-and-comers is always on the lookout for "the R's" interests.]

In the figure above, I try to convey that, with the Fed, there are so many entities that overlap, it is often hard to distinguish who does what to whom. In a very real sense, "they" are all in it together[5], and "we" are the distinct befuddled masses who take it every day up the ol' wazoo.

Back to the Book of the Century...

Dr. Ron Paul, as many of you know, has been a "hard-money," genuine conservative peace-and-individual-liberty Republican since coming to Washington in the 1970s as a representative from Texas. He even ran for president on the Libertarian ticket in 1988. He starts End the Fed with simple observations about the depleted value of the dollar:

Figure 2: US Dollar Purchasing Power in the 20th Century

He accompanies observations of loss of currency soundness with what we know about the banking and political forces that led to the creation by statute[6] of the Federal Reserve System in 1913. For a deeper look into the "who" behind the Fed, please run-don't-walk to purchase G. Edward Griffin's masterpiece, The Creature from Jekyll Island... a companion 'book of the 20th century' to Dr. Paul's 'book of the 21st century.' If you read Jekyll, you will no longer be guessing about who and what are responsible for taking your money and exactly how they do it: You will know. [If you choose to purchase, please do so thru my Amazon tagged link here.]

Values that Shaped the Good Doctor's Life

For many libertarians, the first few chapters are going to be common knowledge... though RP constantly amazes you with seldom-raised information (e.g. the role of the Panic of 1907 in propagandizing the need for a compulsory central-government money master). In Chapter 3, "My Intellectual Influences," Dr. Paul

tells us his personal story:

Born in 1935, Ron Paul grew up in Pennsylvania, and learned the value of a dollar and personal enterprise from his family environment... through the Depression and the WW2 years of rationing and other economic hardships imposed on the people by government. As a young physician with a natural interest in political-economy, he read widely and in the 1960s discovered the writings of libertarian economists Ludwig von Mises, F.A. Hayek, Murray Rothbard, and Hans Sennholz, among others. He became a firm believer in economic and political freedom as one and the same cause.

In 1971, after Republican president Richard Nixon, stated "We are all Keynesians now," ended gold backing for American dollars, and imposed wage and price controls, Ron got political. Nixon was a major repudiation of sound money and ushered in what we have today... a system of fiat money that keeps generating the illusion of value and safety, while postponing the inevitable recognition that there are no clothes on the emperor.

"The market made every effort to correct the monetary mistakes of these past 37 years. The Fed was able to minimize the corrections only to guarantee the current BIG ONE down the road... meaning worldwide depression worse than the 1930s, unless we wake up rather quickly.

"... Today there's still wishful thinking, but the fiat-dollar reserve standard that the world has blindly accepted for more than three decades is dying and the financial structure is disintegrating. What we decide to do now will affect the well-being of American citizens for decades to come. There's no returning to the fiat-dollar standard that evolved after August 15, 1971." — page 47 and 48

The remainder of Chapter 3 consists of Dr. Paul completing the syllogism of the need for advancing to sound money, especially by reference to the aforementioned intellectual influences. Here's what Ludwig von Mises says:

"The flowering of human society depends on two factors: the intellectual power of outstanding men to conceive sound social and economic theories and the ability of these or other men to make these ideologies palatable to the majority."

Paul follows Chapter 3, which contains most of the theoretical underpinnings for his honest money convictions, with sections that deal with the actual events and people in Washington that have fleshed out the soon-to-go-bye-bye fiat-money system:

Chapter 4: the relationship between the central bank and wars, historically, and through the Vietnam era of "executive-decision" wars. [Hint: without the central banks, wars aren't good for anyone.]

- Chapter 5: going back to the waning years of the Carter administration during which he and other hard money types organized the Gold Commission to proselytize the case for commodity money vs. fiat money.

- Chapter 6: conversations with former libertarian (even Randian) economist-turned-craven-sellout, Federal Reserve Chairman Alan Greenspan; Greenspan made a deal with the Kleptocons to betray economic freedom and he didn't look back.

- Chapter 7: conversations with current Fed chairman Ben Bernanke, Goldman Sachs water boy and all-round Kleptocon enabler; Bailout Ben "ain't tellin' where da money went."

- Chapter 8: Congress' complete ignorance of monetary policy: "I've never heard a member express support for paper money on grounds that it facilitates the expansion of the state. Most don't see the connection at all. They aren't even curious about the topic." — page 115

Where We Are Now

So we now come to the bread and butter of the book in Chapter 9, with a discussion of the specific mess we are in today. One huge discovery of the Austrian School of Economics—von Mises and the others—attributed to F.A. Hayek, in particular, is that state control of the economy always fails for a single, practically self-evident reason: the state requires omniscience to set prices—that is, what any particular good or service will be worth to individuals. Therefore, since the state clearly lacks omniscience, prices are either set too high (creating surpluses) or too low (creating shortages).[7]

State control of money fails for the same reason: nobody knows what the price of money (interest) should be for all the quadrillions of decisions made by would-be borrowers and lenders in all the quintillions of their situations. The Fed, being—despite all the wizardry PR—a bunch of ignorant government peons (whose real mission, anyway, is to loot the public for the benefit of their elite bosses), over the years takes the meataxe approach. It generally sets the interest rates lower than the market would set them.

This explains the expansion of the money supply shown in Figure 2, and why you can buy a car for $1,000 in 1913 that will cost you $25,000 today... assuming we don't experience hyperinflation. Setting interest rates low makes the greatest number of people, consumers, happy. Things look cheap, let's party! Which is where we are today. It's been a spending spree for large sectors of the economy. Today we're at the end of a long run.

The collapse of the stock market in 2000, especially the busting of the NASDAQ bubble, was the beginning of the current crisis, although many want to date the onset in 2007 when the mortgage crisis became obvious. The bull market in stocks had ended long before. The massive inflation that was directed into housing was designed to make people feel better, and consumers once again were enticed to continue their spending spree by borrowing against their home equities, driven up at least nominally by inflationary expectations. Monetary policy was always hostile to savings. Savers were cheated with lower rates of interest. Greenspan's answer to my concerns regarding this point was, more or less, "True, but that's just tough luck." — page 129

Why End the Fed?

Ol' Ron doesn't mince words, he starts off Chapter 10:

"The Federal Reserve should be abolished because it is immoral, unconstitutional, impractical, promotes bad economics, and undermines liberty. Its destructive nature makes it a tool of tyrannical government."

And the remaining chapters outline the case And the remaining chapters outline the case

he makes:

Chapter 11: The Philosophical Case—"Once the principle of force by government is endorsed, it is conceded that the government can run everyone's life as well." It

doesn't take long for a dictatorship to evolve from handing government the reins of economic power.

Chapter 12: The Constitutional Case—"The Constitution is silent on the issue of a central bank, but for anyone who cares about its intent, the 10th Amendment is quite clear. If a power is not 'delegated to the United States by the Constitution,' it doesn't exist.... Even if a central bank were permissible, it could not repeal [the Constitution's] legal tender mandate

for gold and silver coin."

Chapter 13: The Economic Case—"The Fed is responsible

for the boom-bust cycles. It's responsible for price inflation, recession, depression, and excessive debt. Although the central bank can get away with mismanagement of the economy for a long time, its policies are always destructive. Unchecked, the policies of a central bank lead to financial chaos, an example of which we are now experiencing."

Chapter 14: The Libertarian Case—"As the iron fist [of tax-collecting, official looting, police-state prohibitions, etc.] grows in size and the invisible-hand influence on the market lessens, we will see a transformation of America that spells the end of a grand experiment in human liberty."

I want to add that in the economic sphere the country has just about had it up to here seeing Bailout Ben and the Boys hand over the people's hard-earned $trillions to arrogant Wall Street sociopaths. Further, as Dr. Paul does suggest in the Libertarian Case, the ultimate aim of central banks is WAR and DEATH... for PROFIT to the BANKSTERs. The Fed is nothing less than a psychotic serial killer of human beings—that is its prime directive.

A criticism of End the Fed may be that it lacks a fully elaborated plan for what to replace the Fed with. [Paul does describe the workings of banking systems in a free market.] Most of such criticisms fall into the category of the "Ice-Cream Business Fallacy:" no one knows exactly how the ice cream business looks without central planning because it depends on human choices, which basically cannot be known by some "perfect knowing being" outside the sphere of action. Such necessary ignorance bothers people who like to control others, and that's why freedom people like it.

A valid criticism is that End the Fed doesn't proceed through a likely series of legislative steps that, in fact, will end the Fed. Which is a shame, because it's fairly obvious: Passing Ron Paul's current bill to audit the Fed is step one. Next, following the first audit, massive theft will be discovered and the people will:

- order their legislators to prepare a plan for abolishing the central bank in a very short time, and

- in conjunction with that plan, determine the extent and methods of restitution to the taxpayers of $trillions in assets the Fed and its den of thieves has wrongfully obtained

No need for going into great detail, but I do believe Dr. Paul could have been a bit more specific about step 1, as I have been regarding step 2 in my column, "The Big-Three All-American Financial Stimulus Package of 2009."

Final Thoughts

End the Fed is probably not a great book. But it's the perfect book for now. "There is nothing so powerful as an idea whose time has come," says Victor Hugo. And there is nothing else so important to an idea—liberty—than a book that makes the idea crystal clear and stirs the blood. Ron Paul articulates what we in the freedom movement have always aimed for: the victory of our labor of love, our embracing worldview of freedom over the Authoritarian Menace. I believe that through the spread of this book, which drives a well-aimed stake through the heart of this central enemy of humanity, victory is at hand.

This is Tony Robbins big, folks. In fact, I look at End the Fed, as Tiger Woods coming into the Sunday final round of a golf tournament three stokes ahead. End the Fed gives us a three-stroke lead going into Sunday. Now we need to do exactly what Tiger does: focus, then finish the match, relentlessly, one hole at a time.

Ron Paul ends the book with a flourish:

"Among all the arguments that can be used to reject the Federal Reserve, the moral argument alone should suffice: It's cheating. It's a tax. It's counterfeiting. It benefits the few at the expense of the many. It breaks the rule of contracts. It causes suffering and punishes the innocent. It enables world wars and vast payoffs to the powerful. That should be enough for all Americans to call for an end to this 95-year-old failed scheme."

Q.E.D. ###

[1]

He who has the gold makes the rules.

[2]

My SNaP concepts: Most humans are inclined toward the nonaggression princple

and are productive. They disdain and discourage stealing. A handful of defective humans, the parasitical Kleptocons, is responsible for the acceptability of aggression in society—aggression serves their antihuman ends.

[3]

An area in which I have incomplete knowledge: Who controls the non-Western finance bankers, e.g. China, or more renegade Western powers such as Venezuela?

[4]

American trillion = a million million, or a 1 with 12 zeroes following it.

These are estimates from known weatlh of the Rothschild banking dynasty in the mid-19th century. [5]

Check out They Rule for the incestuousness of the power matrix.

[6] No authority exists in the Constitution for a federal bank, period.

[7] If a price is set too high, e.g. price supports for milk, producers will make a buncha milk, but people won't buy it all... and vice versa. [I'm told if Obamacare goes through, the government will commission Michael Moore to develop a special Quija Board for care providers to determine rates for all the medical procedures and surgeries.]

2009 October 19

Copyright © Brian Wright | The Coffee Coaster™

Ron Paul | End the Fed | Federal Reserve | Central Banking | Ludwig von Mises

|