Posted to aid the few other CtC educated filers inflicted by this rogue IRS scam

By Brian R. Wright

“Not to trust but to know.”

“Not to trust but to know.”

— Hank Rearden, Atlas Shrugged

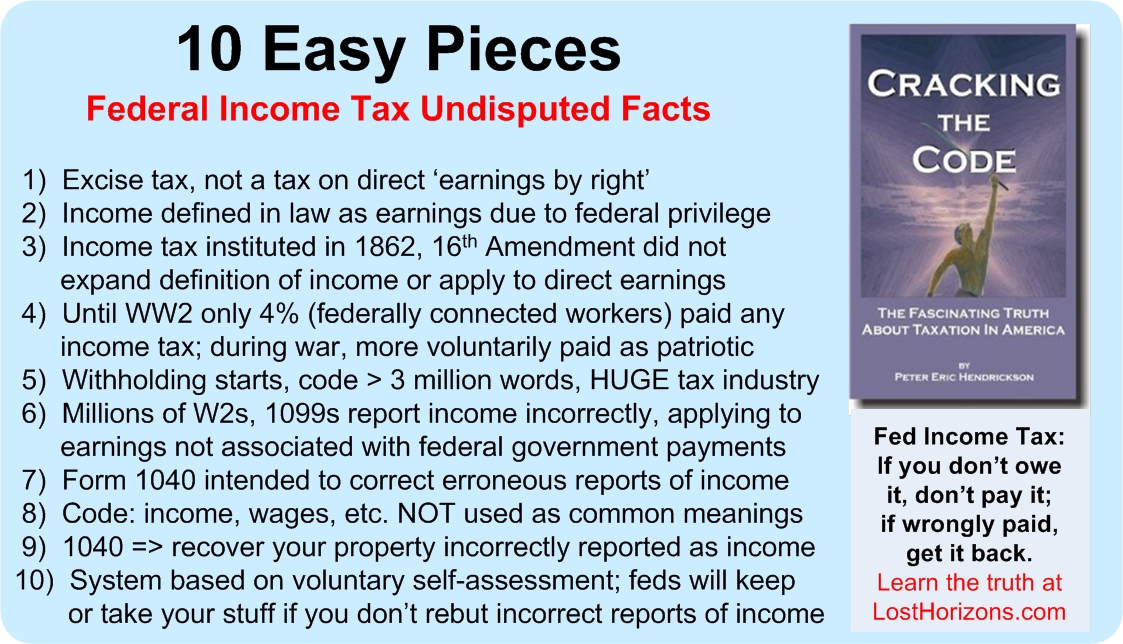

In keeping with the theme of Ayn Rand’s magnum opus—and thanks to Mr. Peter Eric Hendrickson, author of Cracking the Code: The fascinating truth about taxation in America, who has spent countless hours deploying his brilliant mind over volumes of twisted IRS code to come up with perhaps the greatest political-economic discovery of our age—we the (nonfederally paid) American people can now shrug off the former burden of the federal ‘income’ tax legally, prudently, and profitably. The sooner the better.

Like Rand’s Atlas who bore the world of humankind’s sins on his shoulders out of guilt and disinformation, we the people, now being apprised of the Hendrickson Discovery—that the income tax is and always has been an excise tax on the use of a federal privilege (federal government employment or payments)—can let go of the drain on our property and our country. BUT… first there are some mechanics to the process of liberation, fortunately documented well on the Website http://losthorizons.com.

Not everyone wants you to lay down your needless load

That’s the point of my column today. You can go to this page of the Lost Horizons site to scroll down and find my most recent filing, and a note. Also, here’s my column on the victory. And for the most part, 90+% of the time, CtC-educated victories are a simple process of rebutting incorrect W2 and 1099 information reports. Naturally, corrupt forces inside the agency do not want the income tax to be legally applied, hence the latest scam tactic is to pick a handful of educated filers and try to frighten them back into the fold of Ignorance Tax compliance… with threat of a Frivolous Return Penalty (FRP) of $5000. Continue reading