The fascinating truth about taxation in America

by Peter Hendrickson

Review by Brian Wright

Three things cannot be long hidden:

Three things cannot be long hidden:

the sun, the moon, and the truth

— Buddha

For a book that rather prosaically walks the reader thru centuries of political principles, statutes, and regulatory code pertaining to the American federal “income” tax (FIT)[1], Cracking the Code (CtC) is exceptional in so many ways. I especially want to draw the connection between concrete tax resistance or defiance—or in the case of Pete’s book on the FIT, accurate tax definition—and the worldwide movement toward adoption of the simple nonaggression principle in civil societies.

Morality and the Rule of Law

One of the stirringly unique aspects to Cracking the Code, is the way Mr. Hendrickson seamlessly weaves the ethical foundations of our political system into practical tools for holding our government and the FIT to the rule of law. This union of the moral and the practical promises to bring a virtually unquenchable flame of common-sense Constitutional liberty to the dying embers of what was once a glowing American republic.

Regarding the unassailability of common sense: My friend in the Free State, Matt Simon[2], argues: “Stake out and hold the moral high ground. Eventually, through education and political action, what is moral becomes common sense. Common sense wins… as shown from the work of the same name by Thomas Paine, or from the writings of Harriet Beecher Stowe (Uncle Tom’s Cabin), or from Gandhi’s walk to the sea.

Although Pete doesn’t delve into ethics from any particular humanistic or theistic tradition, he accommodates the realm of the “oughts of behavior” in social systems quite deftly. How? By laying out what some key founding fathers and their philosophical peers thought were base principles of civilized, workable society. In a nutshell, these principles were the Rights of Man—rights of the individual to person, to property, to peaceful enjoyment of activity and custom. These men painstakingly, and at great personal cost, created a system of government whose purpose was to secure these Rights. They codified the system in a written constitution.

There are two distinct classes of men… those who pay taxes and those who receive and live upon taxes. — Thomas Paine

This fundamental notion that we not coerce one another, rather that we behave in voluntary relationships, finds its way into the foundation of proper law: individual sovereignty… which was a popular formulation back in the day of our country’s birthing. Pete has a passage that articulates these sovereign pillars as well as anything I’ve read in the literature of liberty:

“A sovereign is a free-standing, independent agent, whose right to exist and act are inherent in nature. The simple and incontrovertible facts are:

- No human being can assert a claim of authority by right over any other human being

- All human agencies are merely subordinate constructs which can claim no authority beyond that of their creators; furthermore, such agencies can assert nothing for themselves, and assertions made on their behalf can have no demonstrable standing beyond that of the speaker or speakers—who are just other human beings

- No one can claim rights superior in quantity or quality to those of anyone else

“Therefore, regardless of whether or not each of us really has a right to act freely, no one else has a right to interfere with our acting freely. So, we are all sovereign by default at least, if not by design. Our power to act is not dependent upon or answerable to any other person or any other person’s creation.”

Then the book follows up with the origin of the law through the legislative process, which in turn derives its legitimate authority from the people who are sovereign actors. Just as others cannot violate the sovereign rights of the individual—no matter how great their number—so, too, neither can the legislature and its laws. The purpose of the law is to secure individual rights not to discard them. Any law that violates rights is null and void.

The Key Argument

In conjunction with the discussion of the roots of law—actually in the very first chapter—the author presents the distinction between direct and indirect taxes. It’s a highly important distinction, and no less a light than Adam Smith, in The Wealth of Nations, rails against direct taxes:

“Smith deplores capitations [direct taxes] as inequitable, inflationary, counterproductive, and destructive of liberty. Importantly, he makes clear that any tax levied upon and/or measured by the exercise of a basic [sovereign] right—such as the right to life, liberty, the ownership of property, working, or engaging in a trade—is a capitation. Indeed, capitations are alternatively known as (and get their name from) “head taxes,” because they fall directly upon the head of the citizen. They must be paid by the citizen, and out of his own funds—simply because he is there exercising his natural powers.”

Hendrickson then points out that the framers of the Constitution were avid and serious fans of Smith’s hugely popular work; they specifically prohibited direct taxes, except by apportionment among the states (and such apportioned direct taxes were thought to be only appropriate as exceptional levies in times of war or other emergencies).

The kicker

None of the federal “income” tax (FIT) acts passed since 1862 have ever been defined as direct taxes, either by their proponents or in the legal language of the statutes enacting them. Indeed, income has a very narrow definition by the statutes as pertaining to receipts from federally privileged activity, such as federal employment or office-holding. To me, the overwhelming discovery by Pete Hendrickson, after taking advantage of the recent ability to search by computer the several million words of statute and internal revenue code, is (paraphrasing from page 3):

Any exchange of value that is measured by the exercise of a basic [sovereign] right—such as the right to life, liberty, the ownership of property, working, or engaging in a trade—is a nonprivileged transaction. It is, in absolutely verifiable fact, not income as scrupulously defined in numerous places in the statutory and regulatory documents. Thus it is not subject to a levy by the federal government. Privileged income—received from federal office or federally privileged financial activities—however, is subject to the “income” tax.

So the essential argument is that FIT is fully constitutional[3], but as a nondirect tax it does not have application to the financial transactions of the vast majority of Americans. The rest of the 232 pages of Cracking the Code consists mainly of a freshly written elaboration of some of the finer points pertaining to meanings of important terms and thorough documentation of all the relevant law, including Supreme Court rulings.

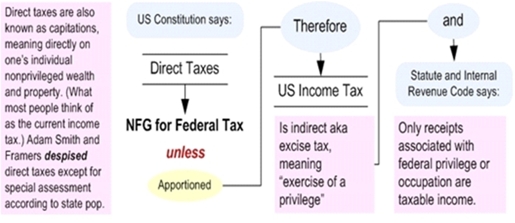

Graphical summary

This is my own take on the message of the book in graphical form: the FIT is an indirect federal assessment upon the exercise of a federal privilege, earnings from a federally nonprivileged activity are not subject to the FIT.

The Restoration-of-the-Republic Argument

As afraid as we may be (to uphold the law), does that excuse us from fighting for liberty, fighting for the moral and legal integrity of our country? These are the kinds of questions one naturally asks during the reading of Cracking the Code. Before we let the king’s men fully forge the chains of tyranny between our ears, Pete reminds us that a little Patrick Henry is in order.[4]

Suppose they give a tax and nobody comes…

Today we stand at the threshold of a radical transformation of society from one of coercion and aggression to one of freedom, peace, and abundance. There are so many organizations arrayed against the <central controlling entity> from which excrescences such as the FIT (as commonly practiced and applied by the money power) emerge. It’s gratifying and rewarding to know there are others who will not submit to chains and slavery.

I want to especially praise Mr. Hendrickson’s contribution to restoring the republic. You will see from the outset that he writes from a place of deep inner peace and passionate love for country. Regardless of any imminent measures of oppression to be unleashed upon us as individuals, I now know the American patriots will prevail. [My next column will discuss the real prospects of full, operating freedom in our time.] Thanks so much, Pete; you have given us vital knowledge in the task of our liberation.

Ten stars! [Well, 9.5: I would have preferred different text formatting, especially in the legal citings.]

Special Note

I should point out that thousands of citizens who have read CtC, filed ‘educated’ forms have received refund checks from Treasury. Pete himself has been subjected to arbitrary law and a two year term in Milan. But that doesn’t alter the truth, any more than putting Galileo in chains meant the Sun revolved around the Earth. Access the CtC site and decide what to do for yourself.

All acts of federal tyranny will be redressed and compensation/restitution rendered upon the restoration of the republic soon to come.

Happy April 15!

###

[1] The quotes around income suggest that the common meaning is not the possibly not the correct meaning.

[2] Matt is the leader of NHCommonSense.org and NHCompassion.org advocating for common-sense rules for marijuana in society.

[3] Some well-known personalities questioning the FIT—from Lynn Johnston to Irwin Schiff—have contended that the FIT is unconstitutional and made other claims… with mixed results. But the government quashes claims of unconstitutionality and generally behaves like a monarchy of arbitrary rule

[4] For a PDF introduction to Cracking the Code, please click on this link. I feel it is vitally important for the freedom movement that Pete’s book be read by millions of people, and quickly. The Oligarchy, of course, blusters along desperately trying to thwart this new, genuine threat to its power. [Check out this hatchet piece from the NY Times Magazine.]

This post has been read 4052 times!

Yes, J, totally awesome. I include Pete’s principles in my Truth Torpedo article (http://brianrwright.com/CoffeeCoasterBlog/?p=1768) and the book to come. Thanks for the comment. I think Pete makes it clear for me just how essential the ban on direct federal taxation (w/o apportionment) is. Article 1, Section 9, has never been repealed! Which is what confuses so many people about the ‘income’ tax. So many think that the 16th Amendment repealed the ban on direct federal taxes, and that just did not happen. What’s soooo encouraging is that the majority of IRS workers are processing educated returns properly and returning property to its rightful owners.

Book is awesome! Got me into studying Law and ohhh, the things I have found that have been “hidden” from the public is crazy, almost unbelievable. I keep my money now that I have seen the truth, and the truth will one day reign supreme.