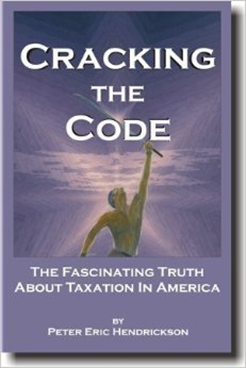

Put CtC and ‘educated filing’ in your Christmas stocking this year and from now on

By Kevin Flanagan

Editor’s note: Still awaiting edits and approval from Mr. Flanagan… and when they arrive, I’ll incorporate. This was pulled from one of the CtC (ref. Pete Hendrickson’s watershed book, Cracking the Code) forums and I haven’t seen a more succinct and to-the-point presentation yet. If I’m the ‘man on the street,’ I’m hooked. This one hits the SWEET SPOT. [Handy single-sheet PDF version for handing to those you like located here.]

Editor’s note: Still awaiting edits and approval from Mr. Flanagan… and when they arrive, I’ll incorporate. This was pulled from one of the CtC (ref. Pete Hendrickson’s watershed book, Cracking the Code) forums and I haven’t seen a more succinct and to-the-point presentation yet. If I’m the ‘man on the street,’ I’m hooked. This one hits the SWEET SPOT. [Handy single-sheet PDF version for handing to those you like located here.]

— brw

Go to LostHorizons (dot) com and get the book Cracking the Code: The Fascinating Truth About Taxation in America. Best $33.95 you will ever spend.

Learn how you can LEGALLY keep all of your property every year (which is what the framers of the Constitution intended, that a man’s labor would never be violated).

The federal income tax is actually written as an excise tax—because a direct tax without apportionment would be unconstitutional [the 16th amendment did not change this]. Excise taxes can only target narrowly defined activities and must be avoidable. Think cigarette tax, if you don’t want to pay it, then don’t smoke.

The activity that the federal income tax targets is the exercise of Federal Privilege. To put it simply and bluntly, the only people who technically owe federal income tax are the ones who have federal earnings; i.e. working for or contracting with the federal government or one of their federal corporations (post office, FDA, etc) or instrumentalities (railroads, national banks, etc.), or receiving federal payments such as Social Security (though most SS benefits are typically specifically excluded from income tax on the 1040). This has been true ever since the first income tax was enacted by Abraham Lincoln in 1862.

The great scam of the IRS was in convincing all companies, not just those federally connected, to begin withholding during WWII—before then, less than 4% of the American adult population paid federal income taxes (Congressional reports from that time period detail this). Most companies complied, not knowing they weren’t legally/technically required to do so. Continue reading