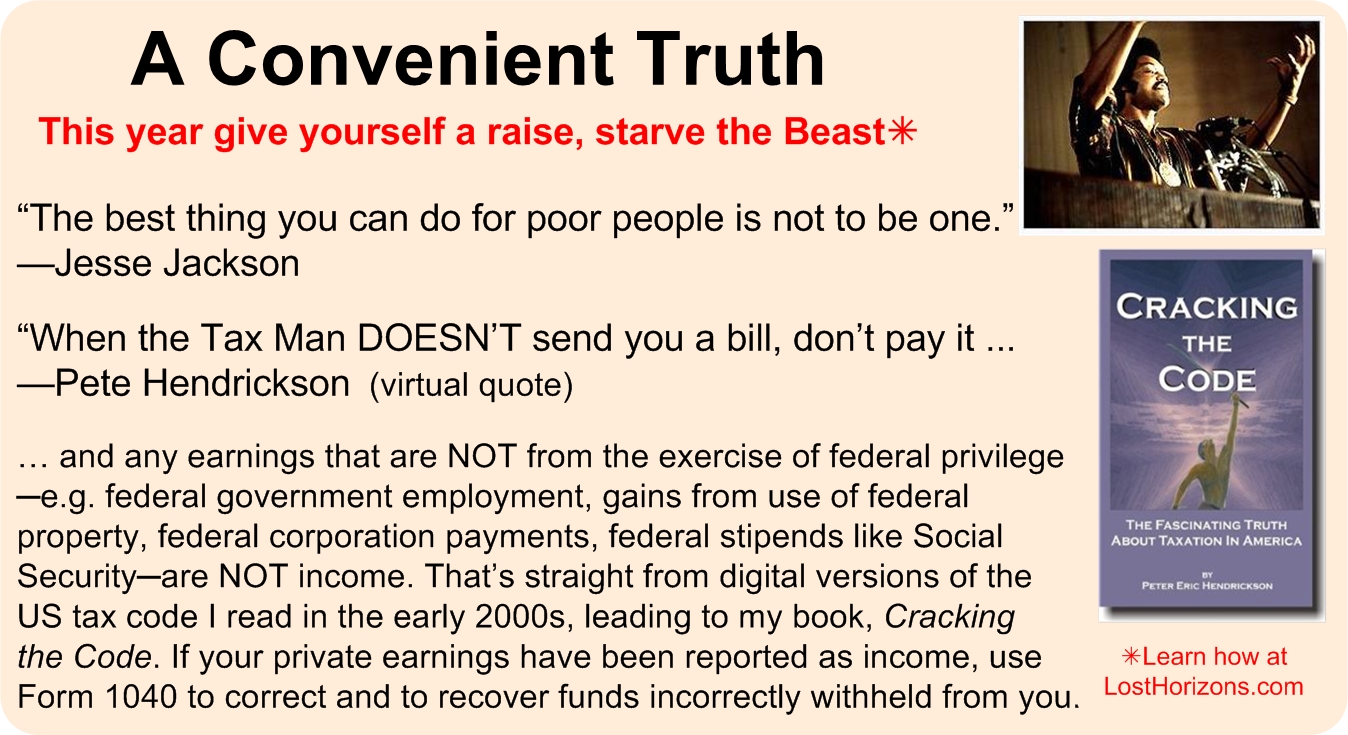

Editor’s Note: The following column appeared recently on the LostHorizons.com site as a Christmas present from its author. Here is the intro from the author on the California Cracking the Code forum:

Editor’s Note: The following column appeared recently on the LostHorizons.com site as a Christmas present from its author. Here is the intro from the author on the California Cracking the Code forum:

Dear Family, Friends, Business Associates, Casual Acquaintances and Libertarian Mentors:

In this time of appreciative giving I wish to share with all of you the precious gift of knowledge. I give this gift with the sole intention of making everyone who has helped make my development as an ardent seeker of freedom, in an otherwise unfree world, more free. In fact if the knowledge that I freely give is actively pursued you may just end up freer that you’d ever imagined you could be. Of course being truly free is not something that is free from effort or achieved by luck alone. But if you build upon the revisionist historical foundation that I give you freely this Christmas your chances of achieving that blissful state of so far unimagined and unrecognized freedom will be vastly improved. I’ll leave it at that other than to hope that however you react to my gift that you all have the best and merriest Christmas’s of all!

The only requirement on your part is to be able to connect to the internet: ANice16thAmendmentSnippet.htm

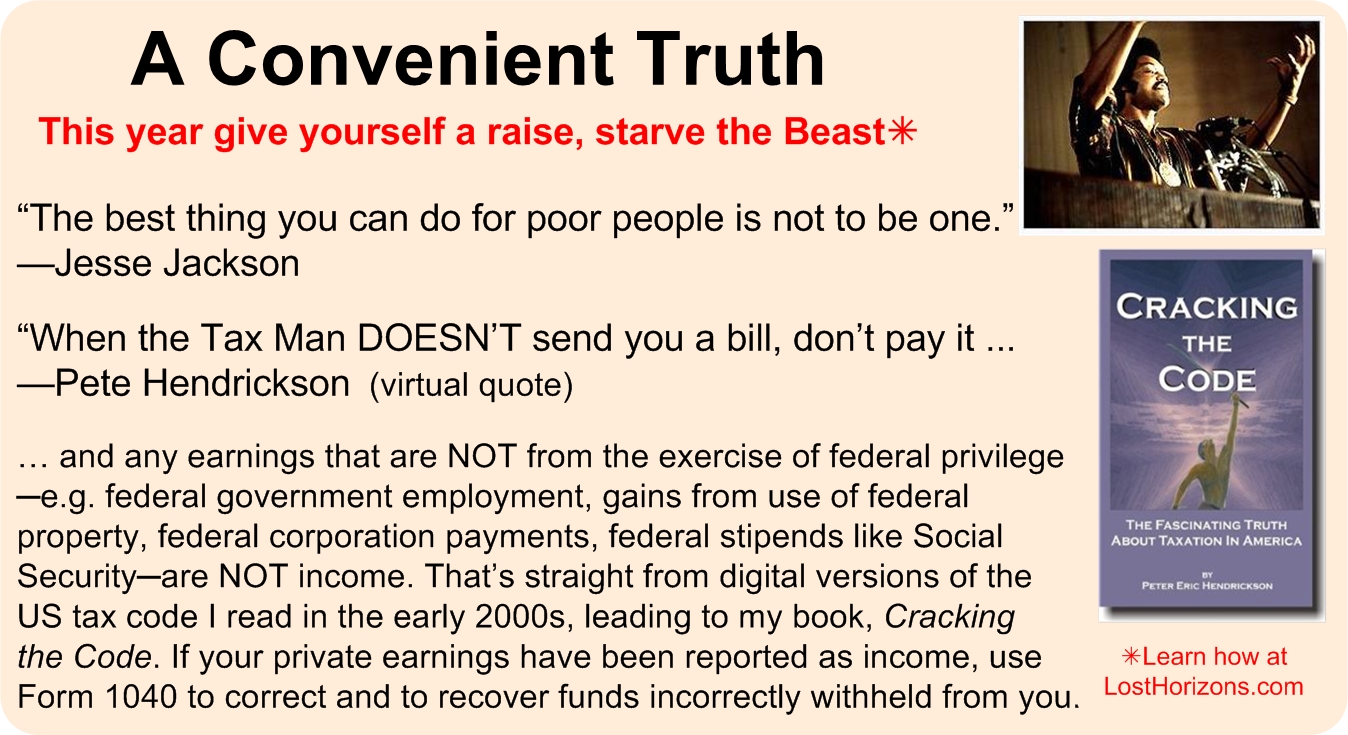

I consider the information in this column by Greg Sutton perhaps the most vital icing on the cake one can imagine of the liberating discovery of Pete Hendrickson in his groundbreaking epic, Cracking the Code: The fascinating truth about taxation in America. Please, please spread this information and Greg’s column on the 16th as if our lives and liberties depend on it. They do. — ed. (brw)

####

IN 1913, AFTER AN EIGHTEEN-YEAR HIATUS, Congress enacted its 20th century revival of the income tax as part of the Revenue Act of 1913. The act became law on October 3 of that year.

The undeservedly maligned and often misunderstood and misrepresented tax was included in the comprehensive revenue legislation package as a result of the 16th Amendment being ratified by the states on February 25, 1913. The Amendment’s intended effect of overturning the Supreme Court’s bare-majority Pollock decision of 1895 had returned to Congress the full palate of taxable privileges that it had originally possessed for revenue purposes before the destructive decision of the Pollock court.

Professor Thomas Powell of Columbia University explained that whole sordid affair succinctly:

“The Pollock Case [1895], with its abandonment of previously well established doctrine, provoked widespread popular criticism. Then followed the movement for the Sixteenth Amendment and its ultimate adoption. The Amendment was very probably widely regarded as in effect a “recall” of the Pollock Case, as the Eleventh Amendment was a recall of Chisholm v. Georgia. … [T]he Income Tax Cases of 1895 were regarded as amendments of what had gone before and that the Sixteenth Amendment was looked upon as a restorative … [and] was a device to repair the damage done to the [unanimous decision] Springer Case [1880] by that bare majority in the Pollock Case.”

Columbia Law Review, 20 Col. L.R. 536 (1920), Prof. Thomas Reed Powell.

The Pollock decision had in effect exempted from the otherwise uniformly applied privilege tax the interest, rent and stock dividends derived from the vast holdings of land granted by Congress to railroad, mining and lumber corporations. The land give-away was one of the means to fulfill the country’s religious like belief in manifest destiny. It began after the southern states had seceded leaving Congress dominated by Henry Clay’s American System proponents. Even with the “Civil War” not going as well as expected and the treasury treacherously diminished, the land give-away started anyway in 1862 with the Pacific Railway Act and continued on unabated by war or economic downturn almost to the turn of the century. Continue reading →

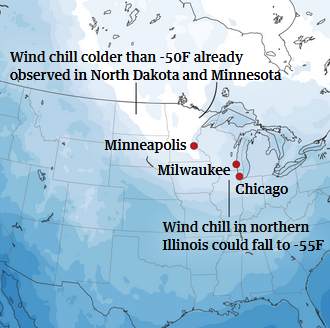

When: Wednesday, January 30, 2019 and Thursday, January 31 ’til noon.

When: Wednesday, January 30, 2019 and Thursday, January 31 ’til noon.