On December 10, the good guys come together…

… or a final nail goes into the rule of law’s coffin. By Pete Hendrickson

LET IT BE SAID PLAINLY: Forcing someone to declare herself indebted to another party– whether by court order or threat of penalty for not making such a declaration– is not a legitimate, lawful act of any organ of the state. Instead, it is a corrupt, tyrannical act, and prohibited by the United States Constitution’s speech, due process and equal protection provisions.

LET IT BE SAID PLAINLY: Forcing someone to declare herself indebted to another party– whether by court order or threat of penalty for not making such a declaration– is not a legitimate, lawful act of any organ of the state. Instead, it is a corrupt, tyrannical act, and prohibited by the United States Constitution’s speech, due process and equal protection provisions.

LET IT BE CLEARLY UNDERSTOOD: Compelling someone to declare a belief that her earnings are “income” taxable by the United States is compelling her to declare herself indebted to the United States (or to declare her agreement with material facts under which the tax debt then arises as a matter of law). Compelling someone to declare her earnings on a line in the “income” section of a testimonial document like a 1040— whether by direct command or by threat of a penalty for not doing so– is compelling her to declare a belief that those earnings are “income” and subject to the tax. Continue reading

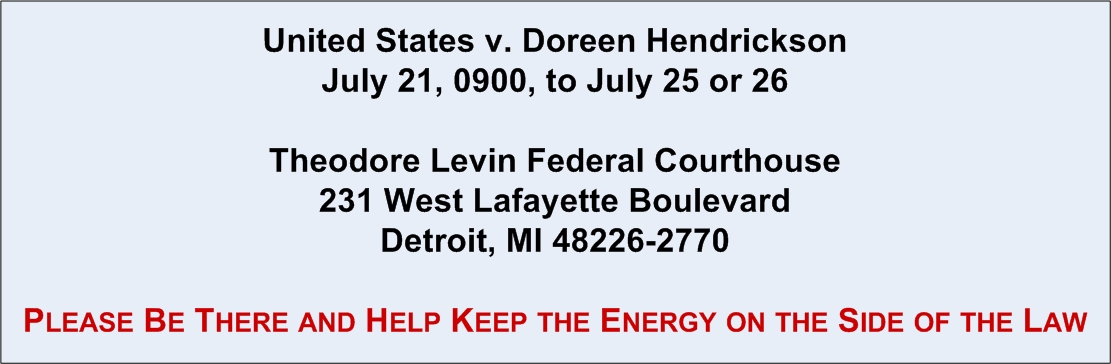

The Motor City Witchcraft Trial(s)

The Motor City Witchcraft Trial(s)